Developing economies in Asia are shunning coal, with new coal-power investments declining rapidly as governments develop and implement clean energy policies. These governments are setting out to prove that you don’t need to invest in fossil fuels to grow economically, as is generally seen as the case and is the route that most developed countries have taken.

—

What is Happening?

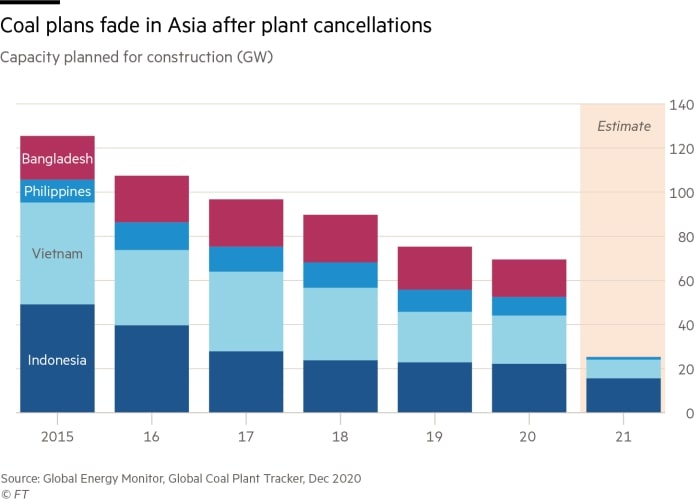

- Policy changes in countries like Vietnam, Indonesia, the Philippines and Bangladesh could mean that just 25GW of new coal-power projects will remain in pre-construction planning stages in 2021, an 80% reduction from the 125GW planned five years ago. In India, planned coal projects will fall to 30GW this year, from 238GW in 2015.

- Among these changes is Vietnam’s new energy plan, expected to be revealed in early 2021. The plan hopes to transition the country away from foreign-funded coal-power producers and towards liquefied natural gas and renewables. In Bangladesh, a policy to scrap all future coal plants is set for the prime minister’s approval. The Philippines also recently declared a moratorium on new coal plants.

You might also like: How Green Hydrogen Can Become a Cost-Competitive Climate Solution

Graph showing how coal projects in Asia are decreasing (Source: Global Energy Monitor, obtained from the Financial Times).

Toby Hassal, lead analyst for coal market research at financial data provider Refinitiv, says, “When it comes to policy decisions [and] the economics of power generation, it seems every day that the outlook for the coal industry gets worse. It comes as no surprise to me that planned coal power stations that have been in the pipeline for a number of years, in places like Vietnam, Indonesia, and India, are increasingly being cancelled.”

- However, there are concerns of increased coal use in the short-term that may threaten long-term transition away from coal and other fossil fuels in Asia. Prices for thermal coal have surged in recent months due to strong demand from China, India, South Korea and Japan. Unfortunately, the International Energy Agency said in December 2020 that global coal demand is forecast to rise by 2.6% in 2021 before flattening out to 2025. However, the Global Energy Monitor says that remaining coal projects are struggling to attract investment.

- While lenders from Japan, South Korea and Singapore have accounted for nearly half the USD$52 billion in coal power finance in Vietnam, Indonesia, the Philippines and Bangladesh since 2015, they are slowly cutting their connections to carbon-intensive power and mining projects. In Japan, the 16 biggest banks have policies to restrict coal finance, Singapore’s biggest three banks have announced plans to stop supporting new coal-power projects, while two of the biggest South Korean coal backers, insurance groups Samsung Life and Samsung Fire & Marine, have made similar pledges.

- However, there are concerns that Chinese groups, already responsible for about 30% of the $52bn, will step in, as Beijing has a lack of regulations linked to controlling finance for foreign coal projects. However, this may soon change after President Xi Jinping made the surprise pledge last year that China would be carbon neutral by 2060. Further, a study backed by China’s environmental ministry has discouraged banks from supporting projects that harm the environment as part of the Belt and Road Initiative.

- However, China must stop adding new capacity to its domestic fleet of coal-fired power plants however, as the Global Energy Monitor tracked an increase in China’s pipeline from 206GW in 2019 to 254GW in 2020.

- Globally, in 2020, the capacity of operating coal-fired power stations shrank for the first time on record, from 2 055GW in 2019 to 2 048GW.