An effective strategy for reducing greenhouse gas (GHG) emissions is vitally important for the success of climate change policies. Carbon pricing is one method used by policymakers and businesses for reducing GHG emissions by putting a price on carbon. So, what is carbon pricing and what are some of the key arguments in promoting its success?

—

What Is Carbon Pricing?

Climate change is no longer considered a ‘soft’ political issue with overwhelming scientific evidence linking the anthropogenically-caused emissions from fossil fuels, such as carbon dioxide and methane, to global warming. Carbon pricing has become an increasingly important strategy within global environmental policy in mitigating GHG emissions since the idea was first introduced in the early 1990s.

Since carbon dioxide is the primary GHG, it is often simply referred to as carbon. Carbon pricing works by putting a monetary value on carbon which makes the cost of emitting carbon explicit to those polluting. This offers a solution for what notable Indian economist Pavan Sukhdev describes as “the economic invisibility of nature”. Hitherto, polluters were able to emit GHG emissions at no extra cost which leaves industrial pollution vulnerable to unregulated exploitation. By placing monetary value on carbon, this is supposed to internalise the external cost of carbon emissions, hereby correcting this market failure.

The logic is that once a price has been placed on carbon, this makes it cheaper and easier for countries to reduce emissions by making carbon a tradable commodity they can use to trade on carbon markets. There are two key contemporary examples of carbon markets and they can both be found in Article 6 of the most recent international treaty on climate change, The Paris Agreement.

The first is an emissions trading system (ETS), also known as ‘cap and trade’ schemes, that works by setting a cap on the total overall emissions target and allocating ‘carbon permits’ accordingly within this threshold. An entity can emit one tonne of carbon by returning one permit or if they need more or less of these permits, they can save, buy, or sell them as necessary. The cap is supposed to be reduced over time so that total emissions will eventually fall. There are a number of examples outside of the Paris Agreement such as the EU ETS, Chinese ETS, and Californian ETS.

The second is a carbon offsetting scheme which provides tradable carbon credits in exchange for emission-saving projects in different parts of the world, outside the capped area. The amount of credits earned is decided by speculating the difference between level of emissions with or without the project. This means that emitters can build projects that save carbon such as monoculture tree plantations or renewable energy projects or invest in green projects, in return for tradable credit.

There is a third type of carbon pricing currently underway which is a carbon tax. This is a form of pollution tax implemented by governments who set a price that emitters must pay for each tonne of GHG emissions polluted. The goal being that the tax will encourage polluters to invest in greener technologies to avoid spending extra money on the tax.

Although carbon pricing varies in logistics they all offer a market-based solution to climate change by assigning monetary value to carbon emissions.This is supposed to provide a financial incentive for the protection of natural resources. According to the United Nations Development Programme (UNDP), the overall objective is to “internalise the environmental and social costs of carbon pollution, and permit trading, which lowers the economic cost of reducing emissions”. Hence, the main goal is to create responsibility for emissions that were previously unaccounted for in a business friendly and cost-effective way.

A Green Political Success Story?

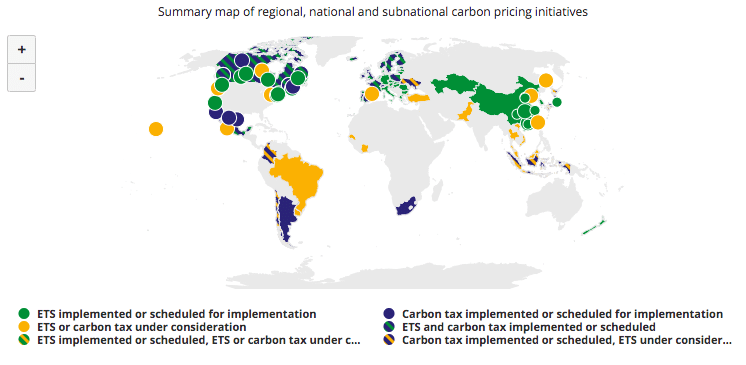

Since the establishment of the first carbon markets, more are being introduced across the globe every year, with even more plans currently expected to roll out. These methods have been introduced internationally, nationally, regionally, and by corporations alike. You can see the 65 carbon pricing initiatives established as of 2021 pictured below.

The World Bank’s Carbon Pricing Dashboard. Image: World Bank.

This growing popularity and political commitment implies a consensus on the success of carbon markets as a tool for combating climate change and transitioning towards a decarbonised economy. Those in favour of carbon markets hail them as a “great political success story” and a significant achievement for global environmental governance. The crucial factors to their popularity are their flexibility and cost-effectiveness, in which proponents argue these business-friendly attributes allow for building a low-carbon, green future.

The market mechanisms that allow for flexible trading opportunities make it a particularly attractive strategy for politicians and businesses who are reluctant to commit to rigid targets that require major regulation or subsidies. They argue that it can be used to stimulate investment, technological development, and create green jobs. This growing popularity is reflected by a growth in price and market growth, that the financial market data analyst, Revinitiv, finds is partly a result of the ambitious targets set at the Paris Agreement.

Revinitiv’s Global Carbon Market Value.

Collectively, the business-friendly attributes of carbon pricing pave the way for what can be referred to as “Climate Capitalism”, a model that promotes decarbonisation of the global economy simultaneously to economic growth.

Limitations of Carbon Pricing

Despite the growing popularity of carbon pricing as a tool to reduce emissions, critics argue that there is a disparity between their popularity and empirical results as an effective tool at reducing emissions, with various limitations to their success.

Environmentalists argue that rather than offer a way to achieve ambitious climate targets, it actually undermines them because they act as a ‘licence to trash’. This refers to the idea that carbon permits allow for ‘business as usual’ practices while claiming a progression towards more sustainable practices, otherwise known as ‘greenwashing’. They argue that this leads to the maintenance of the status quo rather than addressing the root causes of climate change, which they argue requires more systemic changes.

There have been some serious logistical problems for carbon pricing that have subsequently led to limited success in producing actual emission reductions. Below, five major challenges for carbon markets have been highlighted by the UNDP with five possible solutions put forward.

UNDP’s Carbon Markets.

Another limiting factor in the effectiveness of carbon markets’ ability to reduce emissions is its flexibility. This factor can be considered both a strength and a weakness because as a market-mechanism it is vulnerable to market volatility as there is little regulation and is guided by the invisible hand of the market. A recent example of this is the invasion of Ukraine which has led to a decrease in the cost of a carbon permit in the EU’s ETS.

The Main Takeaway

Overall, it appears as though carbon pricing is here to stay. As part of the most recent international treaty on climate change, the Paris Agreement, market-mechanisms such as carbon pricing are becoming an ever present reality in climate policy. Their exponential growth since its inception three decades ago is largely due to its popularity within the political and economic sphere, with supporters heralding it as a flexible and cost-effective method to make polluters responsible for their emissions. As a market-mechanism, it allows polluters to reduce emissions in the way they deem most efficient but is this necessarily the most efficient way to reduce emissions?

Despite its growing popularity, it garners serious criticism from those who question the disparity between its popularity and verifiable success in achieving reduction in emissions. Logistically, carbon pricing requires further work to amend some of the main operational challenges. This could entail some of the solutions put forward by the UNDP such as more robust accounting rules or putting an expiration date on carbon credits.

Ideologically, some of the issues boil down to whether one believes there can truly be a capitalist solution to climate change. A more holistic approach to climate policy includes other methods with greater command-and-control that rely on direct regulation rather than financial incentives. Alongside, as suggested by the UNDP in their recommendations, more ambitious climate targets. This is not a straightforward task, with no ‘one-size-fits-all’ approach. Carbon pricing is not a stand alone solution, nor does it claim to be. It offers one possible solution that can be implemented in conjunction with others on the path to a more sustainable future.

You might also like: Carbon Tax Pros and Cons: Is Carbon Pricing the Right Policy to Implement?